If an order

line cancellation date falls after the FAR675 Cutoff Date, the order line

will appear on the FAR675 report as an exception if it has a balance in

deferred revenue as of the cutoff date.

If an order

line cancellation date falls after the FAR675 Cutoff Date, the order line

will appear on the FAR675 report as an exception if it has a balance in

deferred revenue as of the cutoff date.

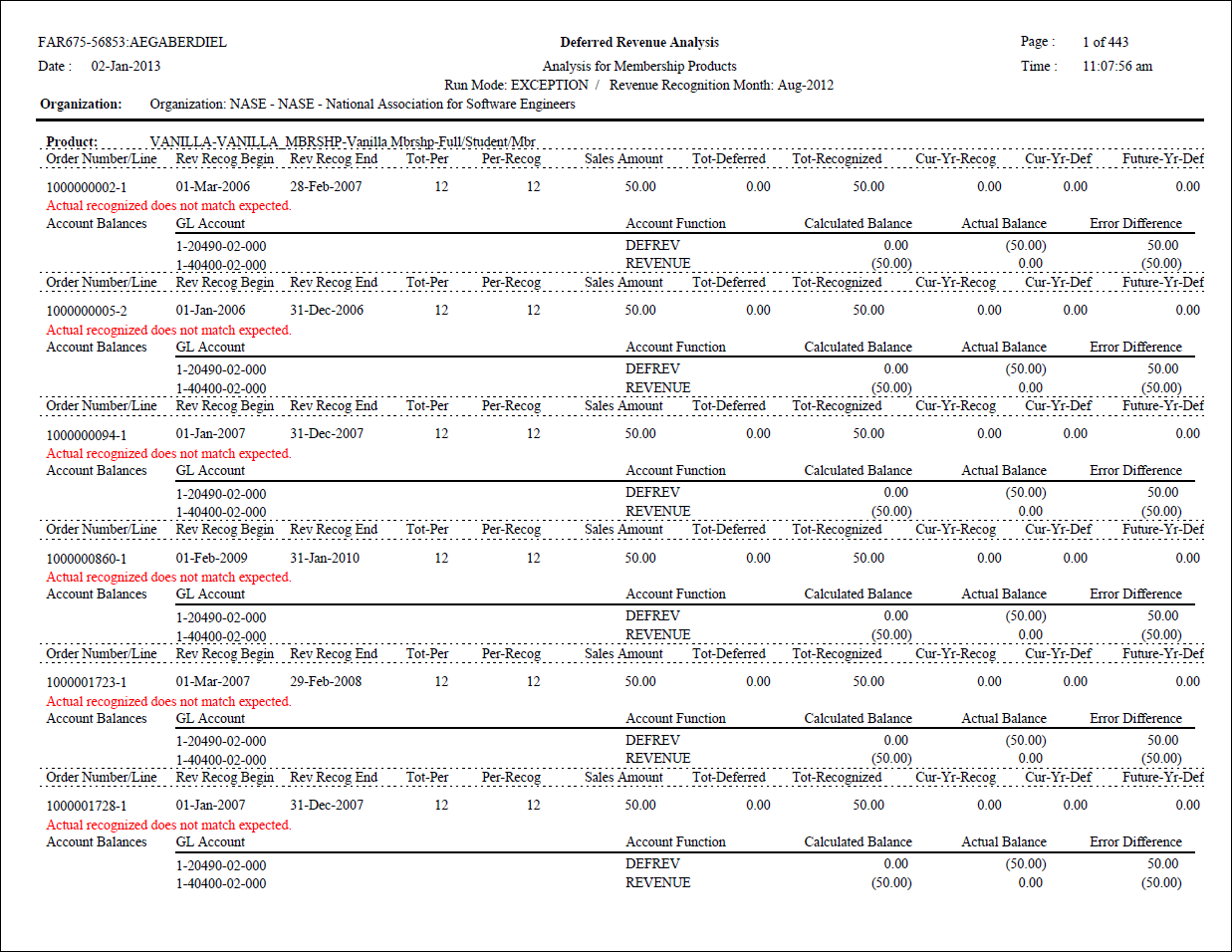

Personify allows an organization to defer revenue for product purchases and then to recognize this revenue over time. The purpose of the FAR675 report is to provide an analysis of how much of each selected order line’s revenue is deferred and how much is recognized and then to summarize that information. This report is intended to show that deferred revenue balances are recorded correctly, or in audit terms “fairly stated”.

This report can also be used to project remaining revenue for the year, and it can be used to verify data conversions.

The FAR675 report is organized by product, and then for each product, includes all selected order lines for that product. Only invoiced order lines are included in the analysis and report. For each order line, the report includes the sales amount, total amount deferred, and total amount recognized. Additionally, the report provides a breakdown of how much is remaining in the deferred accounts for the current fiscal year, along with how much is deferred for future years.

For each revenue and deferred revenue account linked to the order line, the report calculates what the balance should be and also lists the actual balance. If the calculated balance is different than the actual balance, the difference is displayed. Order lines where the calculated deferred balance is different than the actual deferred balance as of the specified cut-off date are identified as exceptions on the report.

Exceptions are not necessarily indicative of a revenue recognition processing error. Variances may be caused by manual adjustments made prior to running of the Revenue Recognition (FAR670) process. For example, if a Cutoff Date is 8/31/2012 and an adjustment is made on 9/15/12, this will be considered an exception until the end of September 2012, when the Revenue Recognition (FAR670) process is run. This is an exception because the projected numbers will include the adjustment, but Far_Txn and Far_Txn_Detail will not as of 8/31/2012. The Revenue Recognition (FAR670) process will balance the recognition, but not until the next time the process is run. Any time that the projections do not support the actual numbers, as of the Cutoff Date specified, the order is considered an exception, even if it is only a timing difference.

A given product in Personify can have many revenue distribution account pairs which link revenue accounts with specific deferred revenue accounts. Revenue and deferred revenue accounts can be used on many products.

As part of each product definition, the revenue recognition method is defined, which identifies how revenue will be recognized. The following is a list of product types with their revenue recognition method:

Subscriptions – Revenue recognition is typically related to the publication (or fulfillment) of an issue. Only if the issue is fulfilled for an active order does the application recognize revenue. Revenue is not recognized on grace issues, replacement issues, or issues that were not mailed because of bad addresses. Revenue is recognized on back issues, which were not grace issues. Therefore, revenue recognition is calculated based on records in the issues served table (Sub_Issue_Fulfillment) and not just based on date ranges.

Memberships – Revenue is recognized based on a period of time, typically monthly. Revenue is not recognized for proforma orders, but back revenue is recognized for orders made active after the membership begin date.

Meetings and Exhibitions – Revenue is recognized once the event has occurred. Revenue is recognized on or after a specific date, rather than a date range.

Facility Reservations – Revenue is recognized once the facility reservation date has occurred. Revenue is recognized on or after a specific date, rather than a date range.

Advertising Orders – Revenue is typically recognized on invoice, because advertising insertion orders are typically not invoiced until after the ad has appeared.

All other orders – Revenue is typically recognized on invoice.

FAR675 should be run after the Revenue Recognition (FAR670) process is run for the month to recognize revenue. If FAR675 is run prior to recognizing revenue for the specified cutoff date, many orders will show up as errors since the amount that should be recognized has not been recognized.

The situations that will cause an order line to be listed as an exception on the FAR675 report are:

If an order

line cancellation date falls after the FAR675 Cutoff Date, the order line

will appear on the FAR675 report as an exception if it has a balance in

deferred revenue as of the cutoff date.

If an order

line cancellation date falls after the FAR675 Cutoff Date, the order line

will appear on the FAR675 report as an exception if it has a balance in

deferred revenue as of the cutoff date.

Income Statements

are cleared at the beginning of each fiscal year, while balance sheet

accounts are not. Revenue and expense accounts are found on the Income

Statement and deferred revenue accounts are found on the Balance Sheet.

Therefore, there is a difference in the amount recorded against a revenue

account and the total that is displayed on the Income Statement if

the order has revenue recognition that crosses fiscal year boundaries.

Income Statements

are cleared at the beginning of each fiscal year, while balance sheet

accounts are not. Revenue and expense accounts are found on the Income

Statement and deferred revenue accounts are found on the Balance Sheet.

Therefore, there is a difference in the amount recorded against a revenue

account and the total that is displayed on the Income Statement if

the order has revenue recognition that crosses fiscal year boundaries.

The number of recognition periods for an order line depends on the revenue recognition method defined for the product. The sales amount of the order line (i.e., the sum of Far_Txn.BASE_AMOUNT for type 4 and 6 transactions) is divided by the number of recognition periods for the order line to identify the revenue amount that should be recognized each period.

The chart below shows the logic that is used by the FAR675 process in calculating the number of revenue recognition periods based on revenue recognition method:

Recognition Method |

Cycle Begin Date |

Cycle End Date |

Total Periods |

Recognized Periods |

|---|---|---|---|---|

| IMMEDIATE | Null | Order_Detail. INVOICE_DATE | 1 | 1 |

| MONTHLY | Order_Detail. CYCLE_BEGIN_DATE | Order_Detail. CYCLE_END_DATE | Periods Between begin and end date | Periods between begin and cutoff date |

| ISSUE | Order_Detail. CYCLE_BEGIN_DATE | Order_Detail. CYCLE_END_DATE | Periods Between begin and end issue | Total fulfilled issues by cutoff date |

| INVOICE | Null | Order_Detail. INVOICE_DATE | 1 | 1 |

| SPECDATE | Null | Product_Account. REVENUE_RECOG_DATE | 1 | 1 |

| BEGIN | Order_Detail. CYCLE_BEGIN_DATE | Null | 1 | 1 |

| END | Null | Cycle_end_date | 1 | 1 |

| YEAREND | Null | Fiscal Year End Date | The number of year-ends crossed. | The number of year-ends between start and cutoff date. |

Periodic revenue recognition includes an additional calculation for short-month processing for memberships and subscriptions defined to recognize revenue on a MONTHLY basis. For memberships and subscriptions that start and end mid-month, a parameter is provided so that organizations can decide whether the recognition has a short period at the beginning or at the end of the recognition. Others want it to be a full month at the beginning and nothing at the end. Note that this may result in a one-year membership having 13 periods if there is a short month in the beginning but the user has forced recognition to the end of the final month, i.e. 1/15/2012-1/31/2013.

The last month of the organization’s fiscal year must be defined.

| Parameter | Description |

|---|---|

| Subtitle | Optional parameter that allows the user to specify a report subtitle that will print as part of the report header. |

| Run Mode |

|

| Earliest Order Date | FAR675 will select orders with an order date greater than or equal to the first of the month of the date selected here to eliminate unnecessary processing time for very old orders. This defaults to 1/1/1960. Note that any date entered here is treated as a full month. |

| Revenue Recognition Month (Cut-Off Date) | FAR675 will select transactions with a transaction date on or prior to the last day of the month of the date selected here. Before running FAR675 for this month, it is important to have already run revenue recognition for the selected month. Note that any date entered here is treated as a full month. This is also called the “cut-off date”. |

| Subsystem | Enter the Subsystem for which to run the deferred revenue analysis. Valid values are INV, SUB, MBR, MTG, MISC, XBT, TRN, CRT, FAC, ADV or ALL. ALL will generate revenue recognition analysis for all the subsystems. |

| Organization | Defaults to the ORG_ID of the logged in user and cannot be changed. |

| Organization Unit | Defaults to the ORG_UNIT_ID of the logged in user and cannot be changed. |

| Parent Product | Select a parent product code to limit analysis to a specific parent product code. |

| Product Code | Select a product code to limit the analysis for a specific product. |

| Short Month Processing | This parameter only applies to MONTHLY revenue recognition method code. MONTHLY revenue recognition is applicable for MBR or SUB Subsystems. The valid values are "BEGIN" or "END". Enter BEGIN to recognize the short month at the beginning of the Membership/Subscription term. Enter END to recognize the short month at the end of the Membership/Subscription term. |

| Select Criteria | Enter a SQL statement to be included in the record selection as an additional clause in the report query. The criteria can be based on far675_vw view. For example : FAR675_VW.PRODUCT_CODE = 'NEWBOOK' |

Order records are first selected from Far675_VW where ORG_ID and ORG_UNIT_ID = ORG_ID, ORG_UNIT_ID values in FAR675 parameters and INVOICE_DATE >= Earliest Order Date parameter and products meet the FAR675 parameter values for Subsystem, Parent Product and Product Code.

The process selects posted sales (TXN_TYPE_CODE = 4) and adjustment (TXN_TYPE_CODE = 6) records from Far_Txn and Far_Txn_Detail for selected order lines where Far_Txn.TXN_DATE <= specified Cut-Off Date and Far_Txn_Detail.TXN_FUNCTION_CODE equals Far675_VW.REAL_TXN_FUNCTION_CODE or Far675_VW. DEF_TXN_FUNCTION_CODE.

Last, the process selects records from Far_Txn_Detail for type 7 revenue/deferred revenue transactions linked to the selected order lines.

| Caption | Field | Description |

|---|---|---|

| Product | Far675_Order_Detail.

PRODUCT_ID, Product.PARENT_PRODUCT, Product.PRODUCT_CODE,

Product.SHORT_NAME |

The FAR675 report is organized first by product. The report does a page break on each change of product. |

| Order Number Line | Far675_Order_Detail. ORDER_NO - ORDER_LINE_NO | The

order number and line number being analyzed.

Format: [order number]-[line number] |

| Rev Recog Begin Date | Far675_Order_Detail. CYCLE_BEGIN_DATE | The value in this field depends on the revenue recognition method and the order line subsystem. For memberships and subscriptions, this is the cycle begin date of the membership or subscription. For meetings, this is the meeting start date. For exhibitions, this is the show begin date. For facility products, this is the room reservation start date. For revenue recognition of IMMEDIATE, INVOICE, SPECDATE and YEAREND, this is left null. |

| Rev Recog End Date | Far675_Order_Detail. CYCLE_END_DATE | The value in this field depends on the revenue recognition method and the order line subsystem. For memberships and subscriptions, this is the cycle end date of the membership or subscription. For meetings, this is the meeting end date. For exhibitions, this is the show end date. For facility products, this is the room reservation end date. For a recognition method of SPECDATE, this is the Product_Account. REVENUE_RECOGNITION_DATE. For recognition method of IMMEDIATE or INVOICE, this is the invoice date. For a recognition method of YEAREND, this is the last day of the fiscal year. |

| Tot Per | Far675_Order_Detail. TOTAL_PERIODS | Identifies the total revenue recognition

periods for the order line. This value is dependent on revenue

recognition method and the subsystem of the order line.

For membership order lines where the recognition method is MONTHLY, the calculation considers the DEFAULT_END_MASK . If the default end mask is 1YRPLUS, if the membership starts on the first day of the month, total periods is set to the number of months between the cycle begin date and cycle end date + 1; if the membership start date is > 1, total periods is set to the number of months between the cycle begin date and the cycle end date. If the default end mask is 1YRMINUS, total periods is set to the number of months between the cycle begin date and cycle end date + 1 unless the day of the cycle begin date is > the day of the cycle end date, in which case total periods is set to the number of months between the cycle begin date and the cycle end date. For subscriptions where revenue is being recognized by ISSUE, total periods is set to the difference between the start issue and the end issue on the order line +1. For other types of revenue recognition methods besides MONTHLY and ISSUE, see the chart in the “Calculating Number of Recognition Periods for an Order Line” above in the section entitled “Summary of Processing Logic” in the Overview. |

| Per Recog | Far675_Order_Detail. RECOGNIZED_PERIODS | Number of periods that should be

recognized based on the recognition start date and the cut-off

date. This value is dependent on revenue recognition method and

the subsystem of the order line.

For membership order lines where the recognition method is MONTHLY, the calculation considers the DEFAULT_END_MASK . If the default end mask is 1YRPLUS, if the membership starts on the first day of the month or if the Short Month Processing parameter has been set to BEGIN, recognized periods is set to the number of months between the cycle begin date and cut-off date + 1; if the membership start date is > 1, recognized periods is set to the number of months between the cycle begin date and the cut-off date. If the default end mask is 1YRMINUS, recognized periods is set to the number of months between the cycle begin date and cut=off date + 1. For subscriptions where revenue is being recognized by ISSUE, recognized periods is set to the number of issues that have been fulfilled (excluding supplements, grace and replacement issues) in Sub_Issue_Fulfillment where the ISSUE_DATE falls between the CYCLE_BEGIN_DATE and CYCLE_END_DATE of the subscription order. For other types of revenue recognition methods besides MONTHLY and ISSUE, see the chart in the “Calculating Number of Recognition Periods for an Order Line” above in the section entitled “Summary of Processing Logic” in the Overview. |

| Sales Amount | Far675_Order_Detail. SALES_AMOUNT | The sales amount that will be used

to calculate expected revenue recognition. This amount

will be divided by the number of recognition periods for the order

line times the number of expected recognized periods.

This is the sum of BASE_AMOUNT * -1 from Far_Txn_Detail where TXN_FUNCTION_CODE in 'REVENUE', 'DEFSHIP', 'SHIP', 'DISC', 'DEFDISC', 'DEFAGDIS', 'AGDISC', 'DEFREV' and Far_Txn.TXN_TYPE_CODE in 4,6 and Far_Txn.TXN_DATE <= CutoffDate |

| Tot Deferred | Far675_Order_Detail. TOTAL_DEFERRED_AMOUNT | The amount of revenue for the order

line that has been deferred.

This is the sum of BASE_AMOUNT * -1 from Far_Txn_Detail where TXN_FUNCTION_CODE in 'DEFSHIP', 'DEFDISC', 'DEFAGDIS', 'DEFREV' and Far_Txn.TXN_TYPE_CODE in 4,6,7 and Far_Txn.TXN_DATE <= CutoffDate for type 4,6 transactions. + Sum of FAR675 calculated TOTAL_AMOUNT where txn_function_code IN 'DEFREV', 'DEFSHIP', 'DEFDISC', 'DEFAGDIS' Calculation of FAR675 calculated TOTAL_AMOUNT 1) Get BASE_AMOUNT from Far_Txn_Detail table where Far_Txn.TXN_TYPE_CODE In 4, 6 and Far_Txn.POSTED_FLAG= 'Y' and Fr_Txn.TXN_DATE < cut- off date parameter and Far_Txn_Detail.TXN_FUNCTION_CODE is equal to REAL_TXN_FUNCTION_CODE or DEF_TXN_FUNCTION_CODE 2) Multiply with Distribution percentage for REVENUE records only. This is based on the revenue distribution percentage defined in product setup. 3) Multiply with the FACTOR received from FAR675_get_period_duration function. Factor is calculated as follows: For REVENUE_RECOG_METHOD_CODE 'MONTHLY' >> @Period/@Duration 'BEGIN' >> Begin Date <= CutOff Date then 1 else 0 'END' >> End Date <= CutOff Date then 1 else 0 'SPECDATE' >>Begin Date<=CutOff Date then 1 else 0 'YEAREND' >> For 'MBR','SUB' > @Period/@Duration Others > Begin Date<=YearEnd Date then 1 else 0 (YearEnd Date = Last Fiscal end date) 'ISSUE' >> Issues_Fulfilled / Total Issues 4) Get the records where recognition_status_code <> 'C' and REVENUE_RECOG_METHOD_CODE <> 'INVOICE' 5) Add Base_Amount from FAR_TXN_DETAIL where TXN_Type = 7 |

| Tot Recognized | Far675_Order_Detail. TOTAL_RECOGNIZED_AMOUNT | Far675_Order_Detail. SALES_AMOUNT - Far675_Order_Detail. TOTAL_DEFERRED_AMOUNT |

| Cur Yr Recog | Far675_Order_Detail. CURRENT_YEAR_RECOGNIZED_ AMOUNT | Calculates the amount of revenue

recognized in the current year through the cut-off date.

Number of periods to be recognized through cut-off date in the current year / total_periods * (Sum of Base_Amount*-1 from FAR_TXN_DETAIL where txn_function_code in 'DEFSHIP', 'DEFDISC', 'DEFAGDIS', 'DEFREV' and TXN_TYPE_CODE in 4,6,7 and txn_date <= CutoffDate for type 4,6 transactions and line_status_code = 'C' for Type 7 transactions. + Sum of Base_Amount*-1 from FAR_TXN_DETAIL where and txn_function_code IN 'REVENUE', 'SHIP', 'DISC', 'AGDISC' and TXN_TYPE_CODE in 4,6 |

| Cur Yr Def | Far675_Order_Detail. CURRENT_YEAR_DEFERRED_ AMOUNT | The amount of revenue for the current

fiscal year that has been deferred.

This is calculated by taking total_deferred_amount * (current_year_periods – current year periods through cut-off date ) / ( total_periods - recognized_periods ) |

| Future Yr Def | Far675_Order_Detail. FUTURE_YEARS_DEFERRED_ AMOUNT | The amount of revenue for future

fiscal years that has been deferred.

total_deferred_amount - current_year_deferred_amount |

| (Exception Flag) | Far675_Order_Detail. EXCEPTION_FLAG | Not visible on the screen. Set to Y if an exception condition is identified in the order line. |

| (Exception Description) | Far675_Order_Detail. EXCEPTION_DESCR | Message that identifies the exception

condition, which includes:

Actual recognized does not match expected.' where FAR675_FAR_TXN_DETAIL.ERROR_DIFFERENCE<>0 'Expired MBR order with deferred revenue.' Where fulfill_status_code = E and 'MBR' 'Expired SUB order with deferred revenue.' Where fulfill_status_code = E and 'SUB' |

Account Balances |

||

| GL Account | Far675_Far_Txn_Detail. ACCOUNT | Far_Txn_Detail.ACCOUNT |

| Account Function | Far675_Far_Txn_Detail. TXN_FUNCTION_CODE | Far_Txn_Detail.TXN_FUNCTION_CODE |

| Calculated Balance | Far675_Far_Txn_Detail. ACCOUNT_BALANCE | Sum of far675 Calculated1 total_amount*-1 where txn_function_code IN 'DEFREV', 'DEFSHIP', 'DEFDISC', 'DEFAGDIS' + Sum of far675 Calculated2 total_amount where txn_function_code IN 'DEFREV', 'DEFSHIP', 'DEFDISC', 'DEFAGDIS' + Sum of Base_Amount from FAR_TXN_DETAIL where txn_function_code in 'DEFSHIP', 'DEFDISC', 'DEFAGDIS', 'DEFREV' and TXN_TYPE_CODE in 4,6,7 and txn_date <= CutoffDate for type 4,6 transactions. |

| Actual Balance | Far675_Far_Txn_Detail. BASE_AMOUNT | Sum of Base_Amount from FAR_TXN_DETAIL

where txn_function_code in 'DEFSHIP', 'DEFDISC', 'DEFAGDIS',

'DEFREV' and TXN_TYPE_CODE in 4,6,7 and txn_date <= CutoffDate for type 4,6 transactions. |

| Error Difference | Far675_Far_Txn_Detail. ERROR_DIFFERENCE | account_balance - base_amount |

Product Summary Totals |

||

| Product Summary Totals | Subtotal of all amounts listed in the detail report for each product. | |

| Orders Processed | Distinct count of order number, order line number | |

| Total Sales Amount | Sum of Far675_Order_Detail. SALES_AMOUNT | |

| Tot Deferred | Sum of Far675_Order_Detail. TOTAL_DEFERRED_AMOUNT | |

| Tot Recognized | Sum of Far675_Order_Detail. TOTAL_RECOGNIZED_AMOUNT | |

| Cur Yr Recognized | Sum of Far675_Order_Detail. CURRENT_YEAR_RECOGNIZED_ AMOUNT | |

| Cur Yr Deferred | Sum of Far675_Order_Detail. CURRENT_YEAR_DEFERRED_ AMOUNT | |

| Future Yr Deferred | Sum of Far675_Order_Detail. FUTURE_YEARS_DEFERRED_ AMOUNT | |

| Summary GL Account Totals for Product: | Subtotal of GL Account amounts for each product. | |

Account Balances |

||

| GL Account | Far675_Far_Txn_Detail. ACCOUNT | |

| Account Function | Far675_Far_Txn_Detail. TXN_FUNCTION_CODE | |

| Calculated Balance | Sum of Far675_Far_Txn_Detail. ACCOUNT_BALANCE | |

| Actual Balance | Sum of Far675_Far_Txn_Detail. BASE_AMOUNT | |

| Error Difference | Sum of Far675_Far_Txn_Detail. ERROR_DIFFERENCE | |

Report Summary Totals |

||

| Report Summary Totals: | Grand total of amounts listed in the detail report for all product order lines. | |

| Orders Processed | Distinct count of order number, order line number | |

| Total Sales Amount | Sum of Far675_Order_Detail. SALES_AMOUNT | |

| Tot Deferred | Sum of Far675_Order_Detail. TOTAL_DEFERRED_AMOUNT | |

| Tot Recognized | Sum of Far675_Order_Detail. TOTAL_RECOGNIZED_AMOUNT | |

| Cur Yr Recognized | Sum of Far675_Order_Detail. CURRENT_YEAR_RECOGNIZED_ AMOUNT | |

| Cur Yr Deferred | Sum of Far675_Order_Detail. CURRENT_YEAR_DEFERRED_ AMOUNT | |

| Future Yr Deferred | Sum of Far675_Order_Detail. FUTURE_YEARS_DEFERRED_ AMOUNT | |

| Summary GL Account Totals for All Product: | Grand total of GL Account amounts for all products. | |

Account Balances |

||

| GL Account | Far675_Far_Txn_Detail. ACCOUNT | |

| Account Function | Far675_Far_Txn_Detail. TXN_FUNCTION_CODE | |

| Calculated Balance | Sum of Far675_Far_Txn_Detail. ACCOUNT_BALANCE | |

| Actual Balance | Sum of Far675_Far_Txn_Detail. BASE_AMOUNT | |

| Error Difference | Sum of Far675_Far_Txn_Detail. ERROR_DIFFERENCE | |